India’s economy is set to bounce back strongly in 2021 as businesses return to pre-COVID-19 levels. Even though the pandemic is far from over, India is learning to live with the virus. India is expected to be the fastest-growing Asian economy in 2021 and its recent forecasts have pegged the Indian economy to grow at 9.9 per cent in 2021 – faster than China and Singapore.

We briefly spotlight the factors that have contributed to this sense of optimism:

Renewed thrust on manufacturing

With low labour costs, attractive incentives for new manufacturing enterprises, and a reduced corporate tax rate, India has emerged as an alternative hub for global manufacturing.

The Government of India has put in place a number of policy initiatives to make the country a global manufacturing hub under the overarching plan of ‘Atmanirbhar Bharat’ or ‘Self Reliant India’. ‘Vocal for Local’ and ‘Make in India’ initiatives have been supported by business-friendly reforms and incentive schemes to attract foreign manufacturing companies.

In November 2020, the government approved the extension of its Production-Linked Incentive (PLI) Scheme to 10 flagship sectors, with incentives totalling INR 1.46 trillion (US$19.54 billion). The PLI scheme had previously benefited three major sectors – mobile manufacturing and electric components, pharmaceutical, and medical device manufacturing.

Recently, Apple’s three major manufacturing partners – Foxconn, Wistron, and Pegatron, along with Samsung Electronics were among a list of global firms that were cleared by the government of India for a US$143 billion Make-in-India Plan.

In October 2019, the government of India reduced the corporate tax rates for new manufacturing firms from 25 per cent to 15 per cent (effective tax rate 17.01 per cent, inclusive of surcharge and cess). The lower tax rate has allowed India to compete with ASEAN’s emerging economies for foreign investment. India’s large consumer market further adds to its advantage. For foreign companies looking to tap India’s huge market of 1.3 billion people, there could not be a more opportune time.

Liberalization continues to benefit foreign investors

India allows 100 per cent FDI in most of the sectors under the automatic route. To provide more clarity to foreign investors, the government recently published its latest consolidated foreign direct investment policy, which came in effect October 15, 2020.

It must however be noted that a few restrictions have been imposed on FDI – coming in from overseas entities or citizens belonging to neighbouring countries that share a land border with India, including China. This is to prevent the opportunistic takeover of Indian businesses going through a difficult time during the pandemic.

Labour reforms

The Indian government undertook a complete overhaul of India’s contentious labour laws by simplifying and subsuming 29 archaic labour laws into four major labour codes:

- Industrial Relations Code Bill, 2020;

- Code on Social Security Bill, 2020;

- Occupational Safety, Health and Working Conditions Code Bill, 2020 and

- Code on Wages, 2019.

These Codes are in various legislative stages and are expected to be fully implemented by mid-2021.

Among the many “path-breaking” changes, some of the important ones are: to make hiring and firing decisions more flexible for companies, reduce the compliance burden, expand the social security net, and ensure that labour unions give 60 days’ strike notice.

India also happens to offer the most competitive labour costs in Asia, with the national-level minimum wage at around INR 176 (US$2.80) per day, which works out to INR 4,576 (US$62) per month (This is a national floor-level wage – and will vary depending on geographical areas and other criteria).

Sector-based opportunities:

Consumer goods

This is the fourth largest sector of the Indian economy, built on the back of a growing middle class and burgeoning rural consumption. As per a report by FICCI, the Indian retail industry, which is growing at 10 per cent per annum, is expected to almost double to INR 85 trillion (US$11.15 trillion) by 2021, from the current estimated size of INR 45 trillion (US$610.58 billion).

Pharmaceuticals

India is the largest provider of generic medicines globally and is the third-largest pharmaceuticals industry in the world by volume. Rising healthcare awareness due to the pandemic will act as a major driver of growth for this sector. The Government of India recently announced an INR 100 billion (US$1.37 billion) package to boost domestic pharmaceutical manufacturing.

E-commerce

With highs and lows during the early days of lockdown in India, consumers shifted in large numbers to online purchasing. As a result, the major e-commerce players reinforced their logistic capability to meet this growing demand. The new normal has only enlarged the scope of this sector, which is expected to grow to US$200 billion by 2026 from US$38.5 billion in 2017.

India’s e-commerce policy, which has been in the works for over two years, is likely to be out soon, as the government is in the “final stages” of drafting it along with a host of other policies, including the National Logistics Policy and National Retail Trade policy. Undoubtedly, the government will have to walk the tight rope to reconcile the perceived conflicting interests of e-commerce players and the bricks and mortar trader community.

Electronics

The Indian electronic components market is set to grow exponentially – facilitated by its low-cost manufacturing base, huge local demand, and a rapidly developing electronics ecosystem. The government is set to seek a second round of applications next month under the production-linked incentive (PLI) scheme for incentives worth INR 20 billion (US$273 million) over five years.

Information technology

The pandemic was a wake-up call for many organizations to look at their IT infrastructure and security, in light of the increasingly normalized ‘work from home’ culture. The research firm Gartner believes that IT spending in India will grow at six per cent to touch the US$81.9 billion mark in 2021 on account of growth in segments, such as IT services, enterprise software tools, among others.

COVID-19 has accelerated the adoption of digital technologies across segments. Companies have started adopting and improving their existing IT infrastructure not only for growth but also for their ‘survival’.

Evidently, foreign investors see these reforms and policy measures, under implementation by the Government of India, favourably. India received its highest ever FDI in the first five months of this financial year, from April-August 2020, totalling to US$35.73 billion, as compared to the same period in any previous financial year.

The growth of the SMT industry in India and globally

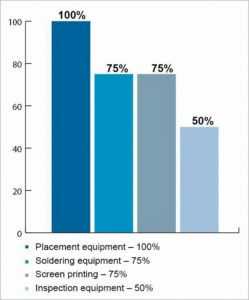

Figure: Expected growth of the SMT manufacturing equipment market in India between 2017 and 2022.

Electronics experts in India feel that if India wants to boost domestic manufacturing to the utmost level possible, then it is imperative to understand the importance of the SMT industry. A Frost and Sullivan report last year stated that due to the growing smartphone and set-top box industries, the nation is going to witness a colossal growth in the SMT industry. It added that the global SMT market is likely to witness about a 9 per cent growth rate between 2018 and 2022. India’s large and diverse population offers a vast market that can give an impetus to technology and electronics companies to commence their operations here, to manufacture both expensive and entry-level gadgets.

A few important schemes and incentives launched by the government that have attracted global companies to India are:

- Modified Special Incentive Package Scheme (MSIPS)

- Electronics Manufacturing Clusters Scheme (EMC)

- Skills Development Scheme

Other factors that make an Indian manufacturing base a good business decision are:

- Huge consumption in the Middle East and in emerging markets across the African continent.

- Existing R&D capabilities can be encouraged to develop ‘Made in India’ products and generate local IP.

Challenges of SMT manufacturing

The SMT industry will continue to face a couple of major hurdles that need to be addressed for its unhindered growth. First, SMT machine precision will be a major challenge. Second, the demand is likely to be more for integrated machines as they can offer one-stop solutions for various requirements. Sophisticated machines coupled with cutting-edge features that can offer solutions to multiple industries will witness a sudden surge in demand. The domestic companies as of now are heading towards the 0201 geometry, which will help them make massive SMT equipment. Machines that can withstand the speedy miniaturisation of electronic circuits will witness a colossal demand.

The post The Factors Driving India’s Electronics Industry appeared first on ELE Times.

No comments:

Post a Comment