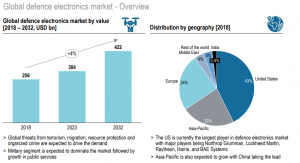

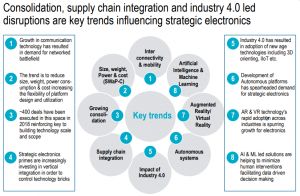

Highlights: Strategic Electronics is the primary capability driver in modern warfare systems with value contribution being more than 40% across leading platforms. The global market for strategic electronics is expected to be USD 256 bn in 2018 and estimated to grow at a CAGR of 4% to reach USD 422 bn by 2032 with US occupying the largest market share. It is expected to be driven by a set of factors including technology, integration, industrial aggregation and Industry 4.0. The Growth in demand for electronics in Indian A&D is driven by modernization of weapon platforms, introduction of state-of-art weapons by the three armed forces, impact of indigenization and Make in India initiative. The demand pool is highly dispersed emanating from more than 45 individual entities operating through more than 100 institutions. It is primarily led by Ministry of Defence, Ministry of Home Affairs & Civil Avionics. Strategic electronics market size in India is expected to be ~USD 6 bn in 2019 and based on already classified plans and orders across various programs, it is estimated to grow at a CAGR of 7% to reach USD 15 bn by 2032. Civil avionics which has traditionally been untouched by Indian players is expected to generate demand worth USD 10 bn over the next 12 years

Private sector players in India’s Strategic electronics (SE) market have ample opportunity to fill the gap at tier 1/ tier 2 / tier 3 spaces in the value chain

- The total opportunity across electronics in programs via Ministry of Defence is estimated to be USD 68 bn with 38% demand from naval electronics

- The total opportunity in programs via Ministry of Home Affairs is USD 58 bn with 45% of the demand from Information, Surveillance, Networks and Forensics

- Detailed assessment of 320 private sector key suppliers in A&D space and capabilities across DPSUs leads to the following observations:

- In case of electronics, India is nearly as competitive as other low cost countries

- India continues to be significantly more attractive in terms of final delivered cost vis-à-vis developed countries/regions

- Overall India’s competitiveness on electronics is bettered only by competitive on engineering and development (services)

- Considering the entire value chain for SE manufacturing, public sector leads the private sector across segments; however in some segments private sector capability and capacity is catching up

- India’s competitiveness is uneven across segments, and whilst there are clear areas where India is a natural sourcing destination, there are also segments where OEMs will have to do significant mining to grow local champions

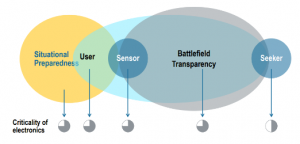

Electronics is primary capability driver for the entire battle value chain from situational awareness to delivery

Defence electronics market is expected to grow at a CAGR of 4% to reach USD 422 bn by 2032 annually

Market opportunities

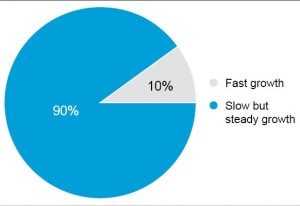

Strategic electronics industry is poised for growth in this financial year. Of them, 90 per cent (Figure 1) feel that the industry will see a slow but steady growth. Experts feel large scale modernisation of India’s defence forces is on the anvil, and the next decade is likely to see an exponential growth in combat systems as well as non-platform based programmes that facilitate the smart battalion. Therefore, the opportunities in Indian electronics are in both standalone systems (as part of platforms) as well as at a sub-system level for other systems.

Figure 1: Forecast of the growth pattern of the SE sector in India

Their prospects for growth will also be driven by the new Defence Procurement Policy (DPP), the offset policies, the Make in India initiative and other key programmes.

According to a report from consultancy firm, Roland Berger, in partnership with two industry associations, the National Association of Software & Services Companies (NASSCOM) and India Electronics and Semiconductor Association (IESA), India’s aerospace and defence industry is expected to consume electronics worth US$ 70-72 billion in the next decade, as the country rapidly modernises its military by embracing new technologies. The same report also indicates that about US$ 53-54 billion will be for electronics acquired as part of platforms (i.e., at the Tier 1 and Tier 2 levels).

Demand for electronics worth US$ 17-18 billion is expected from projects that are traditionally called system-of-systems (non-platform based) applications.

While the above market projections are for the next 10-12 years, there could be additional momentum with other new programmes being announced in the interim. Another growth opportunity is the potential to integrate into global value chains of OEMs (initially leveraging the offset route and, subsequently, based on product quality, service delivery advantages and cost arbitrage).

Demand generating applications

- Tactical communication systems

- Battlefield management systems

- Network-centric warfare systems

- Future infantry soldiers as systems

- Tank electronics

- Air defence systems

- Avionics, navigation equipment, radar and sonar equipment

- Night-vision devices

- A host of associated and embedded electronics

Identifying areas where demand will grow

In spite of huge opportunities, there is a demand-supply gap with respect to the availability of indigenous components, products and solutions, most of which are still imported. Indian companies are not able to cater to requirements that involve low volumes, high technology and high investments.

However, the electronic products and solutions required in large volumes will be in the areas of:

- EMS, build to print (which in the context of defence production, includes firmware updates, test-jig development, manufacturing software development, component procurement, systems integration, software upgrades/enhancement, verification and validation, system deployment, HW qualification, ESS (Environmental Stress Screening), maintenance support, etc), line replaceable units for Indian programmes like LCA, LCH, drones, Kamov helicopters, etc.

- Rugged displays, PDAs, laptops, etc, for the BMS (battlefield management system) project.

- Electronic components, products and solutions used in vehicles for projects like the FICV (Futuristic Infantry Combat Vehicle), self-propelled guns, etc.

Electronics forms a major part of any weapon system. Most of the recent up gradations on the military side have huge scope for electronics, as in the case of the Jaguar upgrade, the Ilyushin aircraft upgrade, the MIG 29 upgrade, T-90 tanks upgrade, and many more. In addition, new ventures like the LCA (light combat aircraft) Tejas, AMCA, production of the EADS CASA C-295 twin-turboprop tactical military transport aircraft jointly by Airbus Defence and Space along with Tata Advanced Systems, single engine aircraft production from SAAB (Gripen) with a yet to be chosen Indian OEM, the FICV project, the missile development programme, the new aircraft carrier, submarines, MCMV, and others— all point to an increased focus on electronics. Critical avionics, night vision devices, missile electronics, electronics warfare (ground based and airborne), software defined radios, robotics, radars (all kinds), UAV electronic navigation systems, weapon sensors, air defence systems, etc., are the much publicised favourites.

In addition to that, single board computers (new technology), advanced PCB design technology, cables and harnesses to meet aerospace standards, etc., are also in demand. Security is a key concern for any defence application. Therefore, there is a huge demand for a holistic security network and indigenously developed security devices. Domestic capabilities are in demand to sustain and upgrade existing systems through innovative maintenance, repair and operational (MRO) solutions.

Offsets to play a key role

Seventy per cent of the experts (Figure 2) feel that offsets will be on the rise. However, in this segment, there is expected to be less emphasis on hardware and a disproportionately larger thrust given to embedded intelligence. Companies in India that are ready to leverage this will grow tremendously. So offsets will have to be defined in terms of service offerings rather than hardware, quite quickly.

‘Design in India’ in focus

All experts feel that in spite of the huge opportunities, the Indian strategic electronics sector is still far from achieving self-reliance due to the absence of integration between R&D and manufacturing. Eighty per cent (Figure 3) of the experts opine that this is the right time to explore the ‘Make in India opportunities by designing in India for our defence electronics needs.

In the last one year, the defence sector got a policy boost through the amendment of the defence procurement policy (DPP 2016). This includes a special category called ‘Buy (Indian – Indigenously Designed, Developed and Manufactured)’ or ‘Buy (Indian-IDDM)’ that will get the highest priority in the defence procurement process. Buy (Indian-IDDM) ranks higher in the procurement process than the ‘Buy and Make (Indian)’, ‘Buy and Make’ and ‘Buy (Global)’, in that order. Inclusion of this new procurement category will provide a greater thrust to the ‘Make in India’ initiative in defence production, focusing on products and solutions designed in India.

This would promote in-house design capabilities and higher localisation, strengthening the domestic industry, especially the private sector, in defence production. However, it is to be noted that the responsibility to prove that a design is indigenous rests with the company, while the final approval would come from the government. This in turn offers unique opportunities to companies that are operating or would like to enter the defence industry specifically in the areas of electronic system design, original design manufacturing (ODM), etc.

The government has already launched some programmes and schemes to facilitate R&D activities in this field. The Technology Development Fund (TDF) and the recently opened Army Design Bureau are worth mentioning here.

Figure 3: Exploring design in India for achieving ‘Make in India’ goals

Figure 4: Views on whether public private partnerships have been successful

Partnering for success

All experts unanimously feel that collaboration is the key to achieve self-reliance in the strategic electronics sector. There is a need for high standards in this industry which can be fulfilled if the Indian industries complement each other rather than compete. They also mention the important role that the TDF and the Army Design Bureau can play to ensure success.

Technology Development Fund

The government has launched the Technology Development Fund (TDF), which aims at funding the development of defence and dual-use technologies that are currently not available with the Indian defence Industry, or have not been developed so far. This will create an ecosystem that will enhance cutting-edge technology capabilities for defence applications. The TDF scheme is being implemented by the Defence Research & Development Organisation (DRDO), and provides for assistance in the form of grants to public and private industries for the design and development of key defence technologies.

The TDF also encourages the participation of public and private industries, especially MSMEs, so as to create an ecosystem that enhances India’s cutting-edge technology capabilities for defence applications.

Figure 6: Views on DPP 2016

How the policies work

In the last one year, the SE (strategic electronics) sector got a policy boost through the amendment of the defence procurement policy (DPP) and the removal of the 49 per cent Foreign Direct Investment (FDI) limit in the defence sector. Of the experts, 75 per cent feel that DPP 2016 is effective enough, plugging all the loopholes of the previous policy. However, the remaining 25 per cent feel it needs more tweaking (Figure 6) and can be effective.

Army Design Bureau (ADB)

The Indian Army has set up the Army Design Bureau (ADB) in an attempt to indigenise procurements and reduce import dependence. It has been established as part of the government’s ‘Make in India’ initiative and will integrate various stakeholders in its long-term requirements.

The post Indigenous Strategic Electronics appeared first on ELE Times.

No comments:

Post a Comment